DeafInvest provides two different kinds of investment services:

Full Hand-On Portfolio Management

What is Full Hand-On Portfolio Management? For one flat fee, you get all services we can offer for your financial needs. Based on the fiduciary interest of DeafInvest clients, DeafInvest provide fee-based investment advisory services only in order to enable clients to obtain the best overall value.

DeafInvest uses Altruist Financial LLC as a broker/dealer and as a custodian. Altruist is the provider of trading platform DeafInvest uses. Altruist is TX based firm that handles multi-billions trading per day for institutions, clients, advisors, and firms. DeafInvest can buy and sell stock, bond, ETF, and mutual fund for clients.

Fee-based means a cost of service will be charged on your asset based on the value of investment. That gives DeafInvest advisor the motivation to grow your value properly because if your investment goes down, so will our fee.

You are what full hand-on service is about You are the center focus of our investment service. Deaflnvest advisors will make sure your financial need, wealth preservation & growth, and assets are well managed for life because you will get a lifetime service from us when you have us as your investment advisor.

DeafInvest provides an all inclusive service and portfolio only service to the clients. The all-inclusive service comes with tax preparation, tax planning, financial planning, wealth management, and personal finance consulting for no additional fee. The portfolio only service is for clients who only needs an investment management service and will pay other services as a separate fee at demand.

No other financial services firm catering to the Deaf community provides a full set of services for one fee.

Robo-advisor Advisory Portfolio Management

DeafInvest uses Betterment as a robo-advisor for a specific audience. What is Betterment? By using Betterment platform technology as the robo-advisor; your access to investment services and investment advisors can be given for a lower fee. Betterment is designed for medium to long term portfolio and uses exchange-traded funds (ETF) only. Betterment has no minimum fee and can set up taxable regular account, IRA, ROTH, SEP IRA, joint, and trust accounts.

See the list of ETFs Betterment uses at HERE. Betterment and DeafInvest believe ETF is a great type of security for clients to have the investments to be made with more flexibility while be able to cover many kinds of markets. ETFS, over long term, are more efficient in managing allocations and risks to grow portfolios over time.

Betterment also offers checking with a debit card and money market account for short-term saving with above average interest rate for no fee. That gives clients the great opportunity to move money between investments and banking accounts easily. Betterment checking accounts cover ATM fee and international exchange fees (as long not excessive).

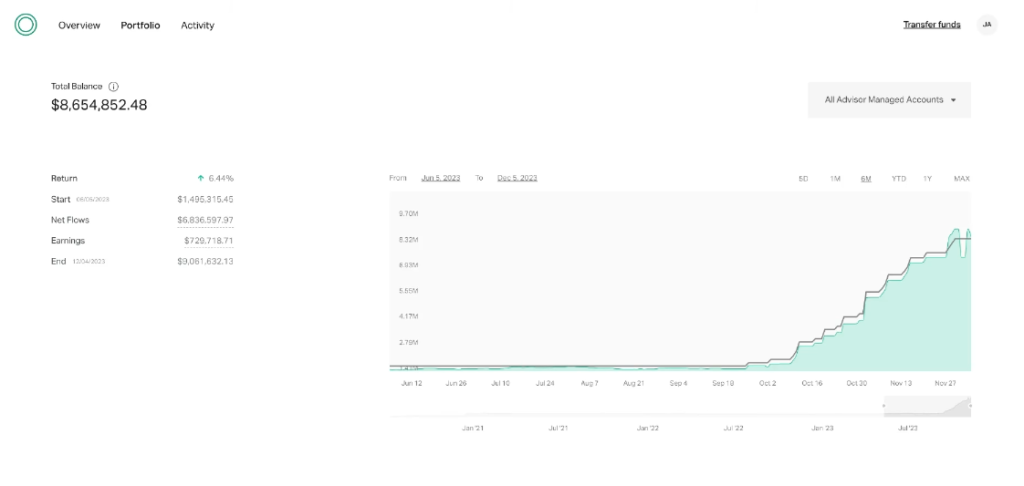

The goal of using Betterment platform is to make your investment accessible to you through computer and phone to allow your advisor to focus on communication with you. Betterment is made for clients who want an ease of use, full viewing of information, and easy visual explanation.

Betterment platform is a straightforward pricing model without transaction charges or hidden fees that focus on the only two investments that matter to most investors – exposures to broad stock markets and diverse bonds. Betterment does these with ETFs.

Betterment platform gives an incredibly easy user experience that makes it easy to understand your money and control your exposure to risk.